Around 400GW of nameplate module manufacturing capacity and nearly 325GW of nameplate cell capacity could be online by the end of 2021, new forecasts from advisory firm Clean Energy Associates (CEA) has said.

And while China will continue to dominate polysilicon production in the coming years, a substantial amount of planned capacity additions are taking place outside Xinjiang, with Europe seeking to attract production to the continent.

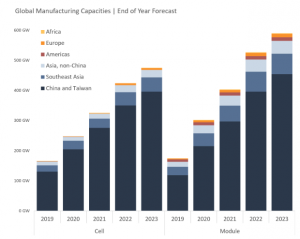

The Q2 edition of CEA’s PV Supplier Market Intelligence Programme report, which delivers in-depth analysis of the solar industry’s leading manufacturers through surveys and interviews, expects 400GW of total nameplate module manufacturing capacity and nearly 325GW of nameplate cell capacity to be online by the end of 2021. China and Taiwan are predicted to remain the top production countries, together accounting for more than 85% of global cell manufacturing capacity and around 75% of global module manufacturing capacity.

Wafer, cell, and module suppliers have been forced to scale down facility utilisation given the high cost of polysilicon coupled with soaring freight costs. Average cell and module utilisation rates in China are currently around 30% to 60% depending on a supplier’s fleet size, said the report. It expects global supplies of both wafers and cells to expand through to 2023, however, with large developers having planned substantial production expansions.

“Small to medium sized suppliers with less than 10 GW of cell and/or module manufacturing are expected to have 2021 plans delayed or cancelled and true end-of-year nameplates may fall below expectations due to low module demand,” said the report.

Production continues to grow year-on-year, with China still dominating both cell and module manufacturing. Source: CEA

Production continues to grow year-on-year, with China still dominating both cell and module manufacturing. Source: CEA

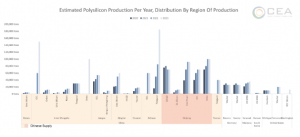

Meanwhile, the report showed how more than 1.2 million tons of polysilicon production are expected to be online by 2023. While most expansions (72%) are planned for outside Xinjiang, most production (89%) will still be located within China. Production outside of China is expected to exceed 130,000 tons by 2023 and is located primarily in Germany and the US.

Almost all major Chinese polysilicon suppliers are looking to increase their production by 100,000 tons by 2023.

In China, almost 75% of new expansions are taking place outside of Xinjiang. Source: CEA

In China, almost 75% of new expansions are taking place outside of Xinjiang. Source: CEA

In Europe, demand for solar increased to 18.2 GW in 2020 from 16.2 GW in 2019, as renewables become an increasingly cheaper option on the continent. An EU focus on establishing a domestic solar supply chain while reducing dependence on China could attract suppliers to the region, although “Europe’s solar manufacturing ecosystem is currently limited by wafer and cell production which accounts for less than 20% of total module production”.

Furthermore, module production capacity is around 25% of module demand in the EU, meaning most installed capacity can be traced back to China.