The global lithium-ion battery market is expected to grow from $40.5 billion in 2020 to $91.9 billion in 2026, per ResearchandMarkets, as demand for electric vehicles, battery energy storage, and electronics continues to ramp up.

With this wellspring of battery creation also comes supply-chain and cost issues that may hamper further U.S. growth in the sector. Research groups and U.S. companies are turning to recycling, reuse and resource reduction as solutions to the problem.

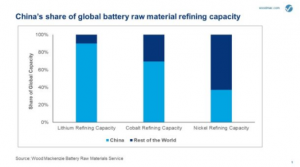

China’s dominance of the lithium-ion supply chain

Lithium battery growth is a part of national plans to evolve and decarbonize the energy and transportation industry, as evidenced by the United States Department of Energy (DOE) announcing $200 million in funding to support the full value chain of batteries, from raw materials to end-user products such as EVs and battery storage systems.

DOE and the Biden administration have identified the need to establish a secure end-to-end battery materials and technology supply chain that supports long-term U.S. economic competitiveness, equitable job creation, and national security.

However, currently the U.S. does not have a strong foothold in the global lithium-ion battery production market, with China standing at 75% of total capacity, per a Wood Mackenzie report. China is investing heavily to build out more manufacturing facilities to extend that dominance, as well.

While the U.S. is making some strides toward manufacturing batteries, they are limping behind in the race for raw materials. China currently has over 80% of the world’s lithium refining capacity, over 60% for cobalt, and more than a third of global nickel refinement, said the report.

The report projects a need for a 70% rise in U.S. production of nickel by 2040; 200% for cobalt; and 600% for lithium. China has positioned itself well for the future of these resources, increasing ownership of cobalt mines in the Democratic Republic of Congo, lithium in Chile, and nickel in Indonesia.

This demand is driving U.S. companies to create innovative methods and build capacities for reusing and recycling these increasingly precious materials.

The current common methods of lithium-ion battery recycling

Recycling and repurposing of materials is one way U.S. companies are staying competitive in this tightening supply chain. The two most common methods for the reuse of lithium-ion battery material are pyrometallurgy and hydrometallurgy.

Pyrometallurgy involves the burning batteries to remove unwanted organic materials and plastic. Generally, pyrometallurgy produces just a fraction of the original material, leaving behind copper, or some nickel and cobalt from the cathode. It is typically done in a fossil-fuel powered furnace, and a lot of aluminum and lithium are lost in the process. While the process is not ideal from an energy and materials standpoint, pyrometallurgical smelters exist commonly and are ready to take on the rising supply of end-of-life batteries.

The other, less common, approach to recycling is called hydrometallurgy. Often called leaching, the process involves soaking the battery cells in acids to dissolve the metals into a solution. This causes a higher amount of useful materials to be drawn out, including lithium. The process is a bit more involved than smelting, and requires the recycler to reprocess the cells, removing plastic casings and draining the charge on the battery.

U.S. commercial models – Recycle

GM is now engaged in raw material recovery through recycling and reuse of excess manufacturing scrap. GM battery maker Ultimum has partnered with Li-Cycle to use hydrometallurgy to repurpose scrap materials from their manufacturing process, deriving cobalt, lithium, nickel, and other useful materials.

Li-Cycle said 95% of the repurposed scrap material can be used in the production of new batteries. About five-to-ten percent of material used in battery production ends up as scrap, said the company.

Li-Cycle also recycles end-of-life batteries, using a hub-and-spoke model to process the materials, with “easily deployable” spokes set up around a hub facility. The spokes shred the batteries, creating a black mass that is then processed at a hub facility into materials that include the three key materials in focus. The company said it will soon be able to process 20,000 tons of end-of-life batteries per year, once its new operations in Arizona are fully operational.

Redwood Materials operates in Carson City, Nevada, taking in batteries from the Tesla Gigafactory that do not meet quality standards to hit the road. They employ a combination of pyrometallurgical and hydrometallurgical processes to repurpose the battery into lithium carbonate, cobalt sulfate, and nickel sulfate.

The company said it can recover between 95-98% of a battery’s nickel, cobalt, copper, aluminum, and graphite, and over 80% of its lithium. Their CEO Eric Straubel said the materials can be reused “almost infinitely” as there is no inherent metal degradation to the metal atoms.

National lab efforts – Reuse

Argonne National Laboratory has been tasked by the DOE with leading the ReCell center, a program dedicated to finding ways to improve lithium-ion recycling techniques.

A key goal of the center is the support of direct recycling. Rather than smelting or breaking down the materials with acid, direct recycling allows components from the battery with complex nanostructures to be reused. That way, raw materials do not have to go through a costly step in being processed back into useable components. The processes for direct recycling have worked in lab trials, but a scalable economic model has yet to be developed.

Another method proposed at the ReCell center is changing the design of batteries so that they are optimized for recycling. Currently, batteries are designed to maximize efficiency, not for reuse. Unless there is a financial incentive in place to reduce efficiency for the sake of recyclability, most companies are not expected to make that change.

One such company supporting this idea of recyclability is Aceleron, who have engineered a simple solution. Most EV batteries have all their cells welded together for a low-cost final product. Aceleron instead connects the cells in a hard-shell case, and each cell is not welded together. This allows a cell to be taken out by removing some nuts and bolts, making it easier for replacement or reuse.

Alternative materials approaches – Reduce

Manufacturing methods for batteries using other less hotly-demanded materials are under development, as well. Tesla and VW are both examining using manganese instead of cobalt, a material more abundant, affordable, and stable in price.

Typical manganese prices can run about $2000 per metric ton, a far cry from cobalt, which has widely ranged from $30,000 to $115,000 per metric ton in the last decade. There are, however, concerns with manganese related to its ability to achieve the same power density as cobalt. It also is less stable in preventing thermal runaway, or fires.

The reduction in need for cobalt, nickel, and lithium will go a long way toward supporting the U.S. goal of being a global leader in energy storage and electric vehicles. With the stage set for China to dominate the supply chain of these materials for the foreseeable future, continued innovation will be key in achieving decarbonizing our transportation sector and hitting energy storage targets.