Understanding the energy transition requires a documented approach, especially when reporting PV capacities, as evolving assumptions change our comprehension of markets. Estimating the newly installed PV capacity is becoming an increasingly complex task, but good quality data is essential to develop an understanding of market trends and long-term evolutions. Without reliable, accurate and pertinent information, policymakers, decision makers and industry stakeholders may not be equipped to respond to market trends according to their strategic goals, such as adapting policies, planning grid expansions, and maintaining system stability.

For several years now, contradictory information has been published on market and market growth estimates. It is to be expected that the distributed nature of PV renders establishing these estimates complex and subject to interpretation, especially as PV development in countries with a reduced ability to track and report PV installations is growing. But the consequence of this difficulty for international organizations and consultancies to report similar numbers is a reduction in confidence in market numbers and subsequently in the PV industry in general.

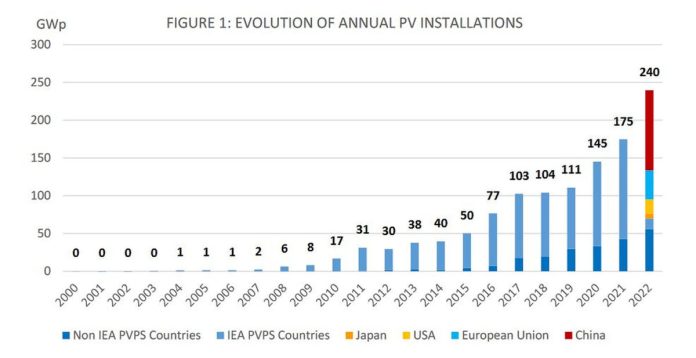

For the year 2022, capacities between 192 GW (IRENA) and 268 GW (BNEF) have been published, and the reality surely lies somewhere in between: IEA-PVPS considers that 240 GW is a decent approximation of the real installation value, counted in Watt-Peak or DC installed capacity. While IRENA refers to AC numbers (or the power output of the inverters, or the grid connection when the information is available), IEA-PVPS reports DC numbers, or the nominal power of the PV modules. Whilst AC and DC numbers are both representative of a reality, DC numbers facilitate calculating energy output, whereas AC numbers refer to the theoretical maximum power output of PV plants.

That AC-DC discrepancy is at the core of numerous misunderstandings in the reporting of PV capacities, and it can be difficult to gain a clear picture of what markets look like. Most recently, Chinese sourced announced in 2022 that their reporting was AC – not DC as international experts had understood, changing final installation numbers by a significant factor:

The China National Energy Administration indicated 87 GW was installed in China in 2022, while the Snapshot of Global PV Markets 2023 by IEA-PVPS indicates 106 GW, an estimate based on AC-DC ratios in China’s utility-scale PV plants.

Given this seemingly wide range of values for data points published by serious, reputable organisations, it can be difficult to decide whose data to use. As a general rule, where two quite different figures are published, it is likely that one organisation publishes DC capacity and the other AC capacity, but what other factors should be considered?.

Many factors can influence how new annual or cumulative PV capacity is reported – there is no international reporting framework for PV – and each country has its own reporting conventions with differences depending on who is collecting data and the purpose of the data collection. In many emerging markets, off-grid or edge-of-the-grid installations are often unreported. Distributed applications cannot always be tracked properly, and conventions add uncertainty to the numbers.

Why does IEA-PVPS select DC numbers? Electricity generation and market turnover, PV module surfaces and land usage are more closely correlated to module DC power than system AC power. Of course, other factors must be taken into account when extrapolating from these values, such as soiling for electricity generation (see the IEA-PVPS 2022 Task 13 Soiling Losses – Impact on the Performance of Photovoltaic Power Plants Report) or average system costs in different segments for market turnover (see the IEA-PVPS Task 1 National Survey Reports for participating countries)。

A margin of uncertainty remains even with data from primary and trusted sources as national experts and analysts have in some cases converted AC capacity to DC, whilst different reporting conventions can mean that repowered and decommissioned capacities are counted differently, or not at all. Micro systems (plug&play) may not be reported in some countries, and it is often the same for off grid systems. In countries with less robust data collection methods, approximate sources and expert guesses give an adequate view considering the low overall volumes involved.

The recently released Snapshot of Global PV Markets 2023 by IEA-PVPS is built on data supplied by country and international experts, inhouse data collection and analysis from report authors, counting both grid-connected and off-grid when numbers are reported, estimating unreported installations and converting installation capacity data to DC. The Snapshot aims to supply coherent, accurate and useful data allowing comparison between countries and across the years.

Growing market

The 240 GW reported this year are an estimate based on the best existing numbers, covering a large part of the global PV market. However, uncertainty exists and should be considered. Compared to the 175 GW installed in 2021, the growth of the PV market could already be considered consistent with the perceived increased interest in solar energy. Reality goes further as by the end of 2022 at least 44 GW of PV was shipped but kept in inventories for future installation. Production numbers for cells and wafers were in the 300 GW range, indicating strong manufacturing confidence in market growth.

The delays seen in 2020 and 2021 due to the pandemic and its impact on PV production and installation has been at least partially compensated in 2022 but will have an impact in 2023 as well, where a much faster growth rate than real installation numbers is expected.

To ensure informed decision making, it is important to choose the right data source, and understand its limitations and advantages. As an early look at last year’s global PV markets, the Snapshot provides readers a quick overview of markets and policy trends that will be investigated in more depth in “Trends in PV Applications,” to be published in the fourth quarter of 2023. With around 240 GW and more in inventories, ready to be installed, the growth of the PV market is accelerating fast, while inadequate reporting is clouding the perception of that growth.

A more robust methodology at national level, especially in emerging countries to track and report PV installations would support the energy transition. A real cooperation between agencies would also support a better reporting and avoiding competing numbers, while the complexity of the entire energy ecosystem is growing.