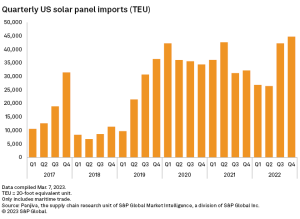

U.S. solar panel imports rose again in the final quarter of 2022, completing a second-half bounce in a rollercoaster year defined by the ups and downs of the federal government’s international trade policy.

The number of shipping containers carrying solar modules to U.S. ports in the fourth quarter of 2022 jumped 39% from a year earlier to 44,712 20-foot equivalent units, according to Panjiva. That marked the highest quarterly solar panel import level recorded by the supply chain research specialist, a unit of S&P Global Market Intelligence.

Quarter-on-quarter imports increased nearly 6%, maintaining an upward trajectory following U.S. President Joe Biden’s June 2022 waiver of import tariffs on certain photovoltaic, or PV, cells and modules from Cambodia, Malaysia, Thailand and Vietnam. A bipartisan group of U.S. lawmakers is seeking to roll back that relief, however, highlighting the solar industry’s ongoing exposure to trade risks.

Solar panel imports for the full year were down 1.4% to 140,263 20-foot equivalent units after shipments plummeted in the first half.

Volumes were also impacted by the enforcement of the Uyghur Forced Labor Prevention Act, a 2021 U.S. law that banned imports linked to China’s Xinjiang region without proof that goods were made without forced labor. U.S. Customs and Border Protection detentions of equipment were largely responsible for an overall 16% annual drop in U.S. solar power capacity additions in 2022, to 20.2 GW, the U.S. Solar Energy Industries Association said in March.

China has consistently denied allegations of forced labor. The law “is built on a lie and designed to impose sanctions on relevant entities and individuals in Xinjiang,” Liu Pengyu, a spokesperson for the Chinese embassy in Washington, D.C., said in an email.

‘Light at the end of the tunnel’

‘Light at the end of the tunnel’

Cambodia, Malaysia, Thailand and Vietnam together accounted for 78.7% of the 672,863 tonnes of U.S. PV module imports in the fourth quarter of 2022, down from roughly 82% in the third quarter of 2022, Panjiva data shows.

The U.S. Commerce Department in December 2022 issued a preliminary decision that certain crystalline solar PV cell and panel imports from those countries are circumventing decade-old tariffs on China. Circumvention may be occurring on a countrywide basis in the four Southeast Asian nations, the agency said.

A final decision in the investigation, requested by small San Jose, Calif.-based PV panel maker Auxin Solar Inc., is expected in May.

Among the largest shippers of PV panels into the U.S. was an affiliate of China-based LONGi Green Energy Technology Co. Ltd., one of several companies preliminarily found to be circumventing tariffs. Others included affiliates of China’s JinkoSolar Holding Co. Ltd., which the Commerce Department preliminarily determined was not circumventing tariffs.

“We have seen the light at the end of the tunnel,” Gener Miao, chief marketing officer of affiliate Jinko Solar Co. Ltd., said on a March 10 earnings call. A bottleneck with U.S. customs inspections “is gradually improving,” Miao said.

First Solar Inc., a U.S. manufacturer of thin-film modules with expanding domestic factories as well as production hubs in Vietnam and Malaysia, was also among the biggest exporters back to its home country.