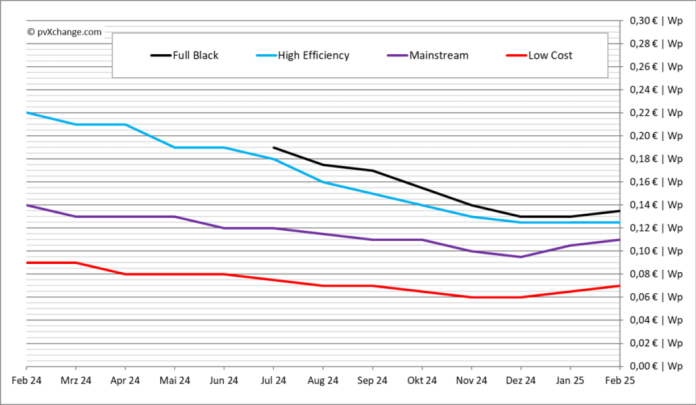

After remaining flat early in the year, module prices have started rising for the first time in more than two years. The increase is affecting all technology classes, including high-efficiency modules, but the change in that category remains too small to register on price charts.

That is likely to shift soon. Few discounted modules remain on the market, as production cuts are driving an artificial shortage. High-efficiency modules are becoming scarce, with no immediate supply in sight.

Some dealers are now stockpiling in response to the expected shortage. These modules will no longer be sold at bargain prices, but held back and repriced to weather the looming supply gap. As a result, module prices will likely rise moderately but steadily until at least early next quarter.

This outlook reflects delays in deliveries from major brands, with restocking for mid-sized PV systems not expected until April or May. Modules for large projects follow separate distribution rules, making their prices less volatile due to longer planning and shipping times.

The impact of production cuts extends across the entire market, including ground-mounted modules. Manufacturers share supply chains, so reduced output affects all module sizes. Some tier-1 Chinese manufacturers have reportedly not produced a single module this year, and decisions on restarting production after Chinese New Year remain uncertain. Many suppliers are still relying on last year’s stock, but fresh deliveries are slowing.

What does this mean for the PV market? Not necessarily bad news.

Overcapacity remains high, particularly in China, but analysts expect global demand for modules to rise while growth slows from 25% to 30% annually to about 8% to 12%. Production capacity still far exceeds demand, with 1,400 GW projected against a forecast of 660 GW to 700 GW in 2025. Factory shutdowns could help ease the supply glut, but they carry ongoing costs, likely forcing smaller manufacturers out of the market.

In Europe, political uncertainty and new regulations are dampening PV demand, pointing to stagnation in major markets. Germany is expected to add just 15 GW this year, a 10% decline from 2024. In 2025, energy storage and flexible consumption will take center stage, driven by the Solar Peak Act. Installers unable to adapt will struggle against larger solution providers like 1Komma5 and Enpal, which already offer AI-powered PV and storage systems and support Germany’s policy shift.

Smaller installers still have options, as many inverter manufacturers now offer open-system or turnkey solutions that help consumers manage energy costs. With well-sized storage and intelligent energy management systems, users can optimize dynamic electricity tariffs – provided network operators finally accelerate the long-delayed smart meter rollout. The latest Erneuerbare-Energien-Gesetz (EEG) adjustments also pave the way for bidirectional EV charging, but automakers must now deliver the necessary hardware.

In a future market with dynamic tariffs and bidirectional charging, PV systems are more than just add-ons – they are essential for maximizing self-sufficiency. However, module price alone is becoming less relevant to overall system economics. Long-term reliability matters more, as maintenance or replacement costs can erode investment returns.

Rising module prices may push manufacturers to invest in higher-quality raw materials, reversing the quality decline seen during the recent low-price phase. Modules sold in bulk to Europe often lacked performance reliability, particularly in top-tier categories, unless buyers secured specific quality agreements. With prices now trending higher, these issues may soon be resolved, allowing end customers to finally get the reliability they expect from their PV systems.

Prices as of Feb. 14, 2025, including changes from the previous month

Image: pvXchange.com

About the author: Martin Schachinger has studied electrical engineering and has been active in the field of solar and renewable energy for almost 30 years. In 2004, he set up the pvXchange.com online trading platform. The company stocks standard components for new installations and solar modules and inverters that are no longer being produced.