Residential PV achieved a 30% increase in installations in 2021, in a standout figure from Rystad Energy’s year-end summary. According to the analysis, solar installations on homes or small businesses grew from 18.9GW in 2020 to 25.2GW.

The result means that residential PV surpassed the C&I segment for the first time, which registered a decline to 19.9GW in 2021, from 20.6GW in 2020.

One reason for the shift is cost dynamics. With PV module prices having largely increased throughout 2021, as a result of a number of supply chain challenges, larger PV projects are more likely to be postponed or delayed, including those planned for C&I rooftops. The residential segment, by contrast, is more insulated from price increases, with labor and sales costs contributing a larger share of overall PV system cost for the end customer.

Rystad reports that PV module costs increased 57% in 2021, from US$0.21/Wp in 2020 to $0.33/Wp this year. Module material cost increases have been blamed for the increase, which was further compounded by high shipping costs.

The burgeoning Chinese residential rooftop segment, which had been long-awaited and arrived with gusto in 2021, is another driver of residential PV expansion. While not noted in the most-recent Rystad analysis, IHS Markit said that in the first seven months of 2021, China saw 7.66GW of residential rooftop installations – and expected 17GW to be installed throughout the year. Chinese homeowners and developers, in figures reported by IHS Markit analyst Holy Hu in October, installed a massive 1.8GW of rooftop PV in July alone.

Utility scale growth deferred not detained

Turning to the big end of town, Rystad found that the utility scale solar segment grew by 15% in 2021. Dampening growth has been some 20GW of PV power plant projects that were deferred or delayed in 2021.

“The renewable energy industry is facing some of its most significant challenges yet over the short term,” reported Rystad Energy’s Head of Renewables Research, Gero Farrugio, in a statement. “But the future has never looked brighter with new and aggressive commitments from governments and companies alike.” Farrugio said that carbon-neutral pledges made at the COP26 negotiations in November are likely to result in “major growth in the coming years.”

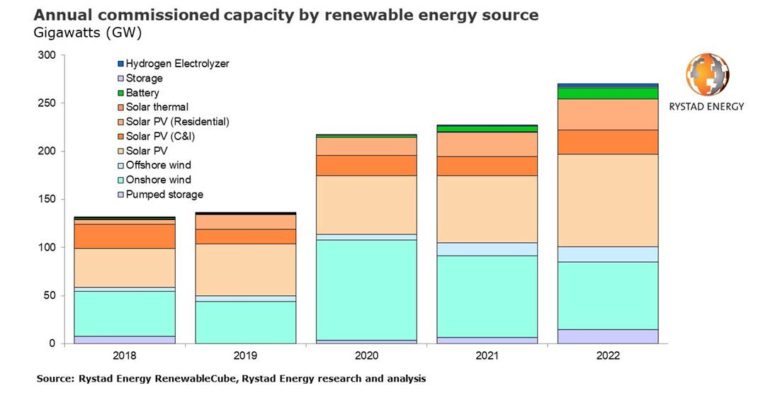

Across the renewable energy sector, offshore wind, utility scale battery storage, and hydrogen electrolyzer installations all saw growth in 2021. Large scale battery installations increased three-fold, and hydrogen electrolyzer capacity expanded from 0.04GW in 2020 to 0.08GW in 2021.

Rystad expects 270GW of renewable energy installations to be installed in 2022 – with solar and green hydrogen leading the way. This is despite ongoing PV module price hikes, with the analysts expecting prices to continue to increase to $0.41/Wp in Q3 2022. Rystad says that 50GW of utility scale projects could be threatened by such high prices, “as their economic feasibility dwindles.”

Renewable project transactions point to continued growth, notes Rystad, with 195GW of utility scale wind project transactions having been concluded as of November 2021. This contrasts to just 14.9GW in 2020. Leading greenfield developers for the year were BP and 7 X Energy, and Repsol and Hectate Energy.

Renewable energy’s arrival on the energy sector mainstage was also highlighted by Rystad, with notable acquisitions such as German developer and EPC ib vogt, by DIF Captial, and Italian developer Falck Renewables, which was snapped up by JP Morgan’s infrastructure investment fund.