The global solar inverter market grew 18% in 2019, according to new data from U.S.-owned analyst Wood Mackenzie.

The WoodMac analysts said two trends were critical: U.S. demand ahead of the reduction in the solar Investment Tax Credit at the end of last year and a rise in demand for the retrofitting of products in operational solar plants.

Asia-Pacific is still the center of global demand although the market declined slightly last year, according to WoodMac.

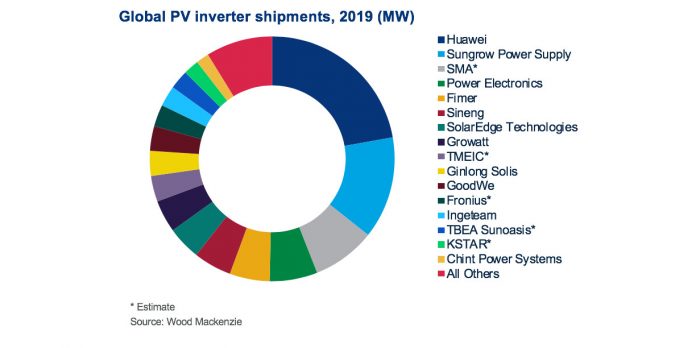

Chinese manufacturer Huawei led the field with the top three manufacturers unchanged for five years. Chinese rival Sungrow had the second biggest slice of the market again, ahead of German outfit SMA. U.S. company Power Electronics claimed fourth position thanks to dominance in its domestic market, even if it lost U.S. market share to Sungrow during the year, according to the WoodMac analysts.

Italian inverter maker Fimer enjoyed the biggest growth, climbing to fifth after it took overthe solar inverter business of Swiss company ABB.

The big five surrendered only 1% of their stranglehold on the global market to claim 56% of business. WoodMac said the 10 biggest inverter makers accounted for 76% of global trade.