Daytime electricity, once the most expensive, is now the cheapest – and sometimes “free” – in many markets due to competition from solar power.

To mitigate the challenge of too much cheap, clean, solar power, developers have coupled energy storage with about a third of all solar power projects in the nation’s construction queues.

However, we’re still very early in the energy storage phase of market development. With that in mind, the Electricity Markets & Policy (EMP) group at Lawrence Berkeley National Laboratory published a document, Influence of Business Models on PV-Battery Dispatch Decisions and Market Value. It analyzes the business cases of 11 utility scale facilities with solar+storage, and provides a list of all projects greater than 1 MW of size.

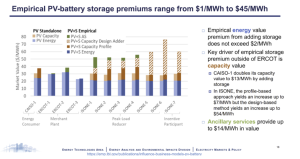

The main takeaway is that “the empirical increase in market value of a PV-battery hybrid relative to a standalone PV plant varies by project and ranges from 0.1¢/kWh to 4.8¢/kWh.”

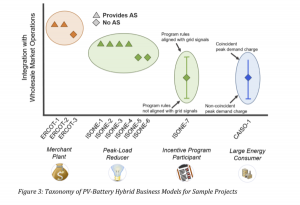

Within the solar+storage industry, it’s well known that most solar+storage power plants do not simply charge with solar in the daytime and sell electricity into the merchant wholesale market at night. Local policy — sometimes at the state level, such as in Massachusetts — or at the regional transmission level — as in Texas or the ISO New England region — are the biggest variables right now driving differences in revenue models.

The 11 case studies were from the California, Texas, and New England power grid regions.

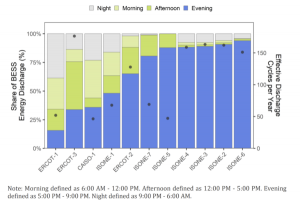

The three projects in the Texas ERCOT region, unsurprisingly, ran as pure merchant facilities. Those facilities buy electricity to charge batteries when the price is low, without discriminating between generation sources or benefiting from the solar investment tax credit. They then sell into the grid when the price is high. In Texas, this peak period often occurs midday as air conditioners turn on.

Projects in the New England region, however, pushed electricity into the evening peak demand period because daytime temperatures are cooler. The New England region has a duck curve – much like California’s – which is largely a result of behind-the-meter solar power in Massachusetts. The duck curve’s effect on market pricing is to drive daytime power down.

In a few years, as the 100 GW of solar power in Texas comes online, that market may shift toward a New England or California-style evening peak price model.

One of the New England solar+storage facilities earns revenue from the still-evolving Massachusetts Clean Peak program. This program requires energy storage to charge with clean electricity – in this case solar power – and dispatch it during the dirtiest, most expensive 10% of demand periods as predetermined by the state over the course of the year.

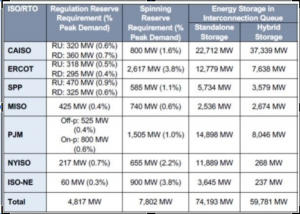

Many of these projects also make money in the ancillary services market. But because the revenue in such markets is limited, the expected volume of energy storage will soon dwarf the revenue available from ancillary services.

The image at left, taken from this document from the EMP lab, shows that roughly 7.8 GW of capacity is needed for spinning reserve services across the nation, versus the more than 100 GW of energy storage already in the queues.

As new energy storage technologies deploy with lower per kilowatt-hour pricing, the transition from evening peak period demand to general merchant electricity will accelerate.

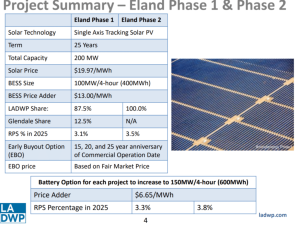

In 2019, we got a chance to see publicly what a large solar+storage plant might charge for its electricity when Los Angeles signed on for the Eland Solar Power Project sold by 8Minute Solar Energy.

The default solar power project, a pair of 200 MWac power plants, was offered with a power purchase agreement of 1.997¢/kWh. Then, two energy storage adders were offered. The first added a 100 MW/400 MWh battery to each facility for an additional 1.3¢/kWh. The second increased the battery sizing to 150 MW/600 MWh for an additional 0.665¢/kWh.

In total, Los Angeles signed on for 400 MWac/~700 MWdc of solar power plus 300 MW/1.2 GWh of energy storage for just under 4¢/kWh, with batteries making up around half of that revenue.

However, again, this project isn’t selling electricity into the wholesale market. Its excess daytime solar will sell at the time of generation, and its energy storage solar power will sell into the evening peaking periods.