Crisis? What crisis? Chinese solar glass manufacturer Xinyi has reported another impressive set of first-half figures despite the Covid-19-related shock which affected the country during the first three months of the year.

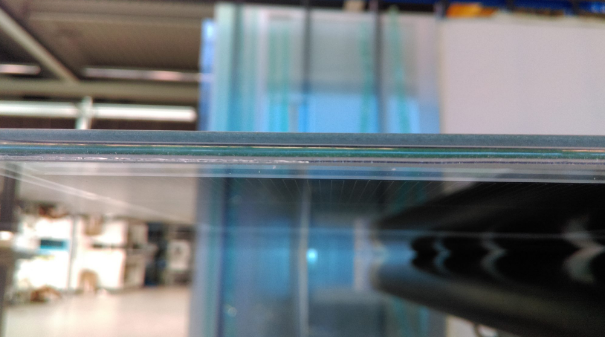

Whilst admitting a national holiday period extended by the pandemic affected processing such as tempering and coating of its products, Xinyi Glass reported its solar furnaces continued to operate uninterrupted during the first six months of the year.

That non-stop production helped drive glass sales worth HK$3.49 billion (US$450 million), up from HK$2.92 billion in the same period of last year, as the company posted total first-half net profits of HK$1.61 billion – up from HK$1.07 billion – and suggested an interim dividend be raised from the HK$0.055 per share handed out in the first six months of last year to HK$0.085.

Although returns were also up in the less important solar project business – from HK$1.02 billion in 1H last year to HK$1.1 billion – and fell in the engineering, procurement and construction services business, from HK$47.6 million to HK$33.8 million, it was the glass division which caught the eye.

Rising glass price

A rising proportion of sales of more lucrative thin glass and a rising average selling price were only partially counterbalanced by exchange rate losses from the renminbi and Malaysian ringgit against the U.S. dollar, for a company with production facilities in China and Malaysia. In fact, although Covid-19 saw the selling price of solar glass 17% lower at the end of June than at the start of the year, the six-month average price was still 3-5% higher than during the same period of last year. That added up to a remarkable gross profit margin rise of 11.6 percentage points for Xinyi’s solar glass, which offered a 38.9% mark-up during the first half.

Although the manufacturer noted the uncertainties affecting demand in a Covid-19 global market, the company is set to press head with plans to open a second 1,000 ton/day-melting-capacity solar glass production line in Guangxi autonomous region this month, having debuted a facility of the same scale there at the end of June. Xinyi said it would open a fresh 1,000-ton line in Anhui in each quarter of next year and is also on track to open its first low-iron silicon sand mine in Guangxi in September, helping to further bear down on raw material costs.

Solar projects

The company reported it had acquired 190 MW of solar project capacity during the first half, with the purchase of three project companies; had developed 270 MW of capacity in China – with 100 MW of it of unsubsidized ‘grid parity’ status; and intends to maintain its generation capacity target of adding 600 MW of projects this year. The company claimed to have 2,920 MW of solar capacity, including 156 MW of PV rooftops, at the end of June.

The investment necessary to surf the global solar wave has seen Xinyi’s cash reserves dwindle from HK$4.35 billion at the end of June last year to HK$2.79 billion at the halfway point this time around, but the balance sheet retains a healthy appearance and that spending included HK$12.1 million donated to combat the spread of the coronavirus, in addition to the raised dividend.

Chinese solar glass company keeps 24-hour furnaces running during Covid crisis

Xinyi Solar has revealed another impressive set of figures and plans another 1,000-ton-per-day production line this month plus a new mine to source raw materials in September.

Source:PV magazine

ViaMAX HALL