A record 31.1GW of clean energy was bought by corporations through power purchase agreements (PPAs) last year, with technology companies once again the largest buyers, according to research firm BloombergNEF (BNEF).

Representing a 24% jump on the previous year’s record of 25.1GW, 2021’s clean energy PPA figures were underpinned by a rise in activity from the largest tech companies, which collectively signed more than half of the deals.

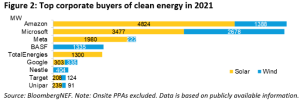

Amazon was the biggest buyer globally for the second year in a row, announcing 44 offsite PPAs in nine countries, totalling 6.2GW. The company said in December it was investing in a host of PV plants in the US and Europe, having signed its first renewables PPA in Japan earlier in the year.

Amazon’s total clean energy PPA capacity is now 13.9GW, making its renewables portfolio the 12th largest globally among all types of companies, just ahead of French utility EDF, according to BNEF.

Announcing its largest-ever renewables PPA deal in July, Microsoft has the next biggest clean energy PPA capacity among corporates, at 8.9GW. It is followed by Meta (formerly Facebook), with 8GW, which last year signed a virtual PPA to procure power from a floating solar project in Singapore.

“The clean energy portfolios of big tech companies now rival those of the world’s biggest utilities,” said BNEF senior associate Helen Dewhurst, adding that the steep increase in tech firms’ clean energy volumes purchased reflects mounting pressure from investors urging them to decarbonise.

Clean energy contracts were publicly announced by more than 137 corporations in 32 countries in 2021, BNEF’s 1H 2022 Corporate Energy Market Outlook reveals, with total signed volumes equivalent to more than 10% of all the renewables capacity added globally last year.

On the other side of the equation, AES sold more clean energy to corporations than any other developer globally, at just under 3GW, according to BNEF. Engie signed more than 2.1GW of PPAs, while Orsted (1.3GW), Vattenfall (800MW) and NextEra (700MW) were also said to have big years.

On the other side of the equation, AES sold more clean energy to corporations than any other developer globally, at just under 3GW, according to BNEF. Engie signed more than 2.1GW of PPAs, while Orsted (1.3GW), Vattenfall (800MW) and NextEra (700MW) were also said to have big years.

By geography, the Americas accounted for two-thirds of clean energy PPA activity in 2021, with 20.3GW of deals announced, 17GW of which were in the US. BNEF said that while virtual PPAs continue to dominate the US market, with 12GW of deals, green tariffs with regulated utilities also experienced a record year, at 3.2GW.

Europe, meanwhile, saw a record 8.7GW of deals announced, with big years from Spain and the Nordics. This uptick was despite PPA prices rising towards the end of the year in response to the continent’s deepening energy crisis

With some developers in Europe looking to capture high wholesale prices, this has led to suggestions that the market is currently undergoing a shift in the balance of power to the seller side.

In Asia, just 2GW of clean energy PPAs were announced last year, according to BNEF, but both China and Japan saw record clean energy certificate issuances, while legislation for a corporate PPA model in South Korea was introduced in October.

Corporate sustainability commitments are a driving force behind clean energy purchases globally, BNEF said, with 67 companies setting a RE100 target in 2021, pledging to offset 100% of their electricity demand with clean energy, bringing the campaign to 355 members.

BNEF head of sustainability research Kyle Harrison said: “More corporations are making new sustainability commitments, costs for renewables are plummeting and regulators around the world are slowly coming around to the fact that clean energy might be a silver bullet in the decarbonisation of the private sector.”