“JinkoSolar’s long-term commitment to R&D has enabled it to continue to launch industry leading products. We have also completed the construction of a high-efficiency laminated perovskite cell technology platform that is expected to reach a breakthrough cell conversion efficiency of over 30% within the year.”

This statement was given by Chinese module maker JinkoSolar in its financial statement for the first quarter of 2021, in which no further details were provided on the in-house development of perovskite cells. The Chinese manufacturer in July 2017 signed a non-exclusive memorandum of understanding with Australia-based Greatcell, formerly Dyesol, to jointly explore commercialization opportunities of Greatcell’s perovskite cell technology.

In the period from January to March, JinkoSolar posted a 6.4% decrease in turnover and a 21.7% decline in net profits in the first quarter of this year.

The company said it achieved first-quarter revenue of RMB7.94 billion ($1.21 billion) and a net result of RMB221.1 million ($33.7 million). The operating result decreased significantly from RMB732.7 million in the first three months of 2020 to RMB149.1 million in the latest quarter and the operating margin dropped year-on-year from 8.6% to 1.9%. The quarterly gross margin was 17.1%, which compares to 19.5% a year earlier.

“During the first quarter, the imbalance between polysilicon supply and strong downstream demand as well as many other factors continued to increase module prices on top of many factors, but we believe the impact on downstream customers is temporary,” JinkoSolar CEO Xiande Li stated. “The lower demand has kept the prices from rising; as the prices of polysilicon stabilize, downstream demand is expected to resume in the second half of the year, with the present polysilicon supply chain sufficient to support 160 GW of installations this year and 210 GW of installations in 2022.”

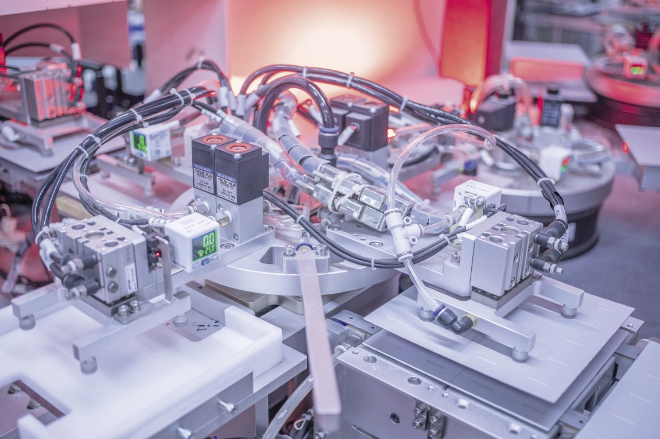

The manufacturer was able to increase total shipments 33.7% year-on-year to 5.35 GW and expects its annual wafer, cell and module production capacity to reach 30 GW, 24 GW and 33 GW, respectively, by the end of this year.

For the second quarter of the fiscal year, the company expects to ship between 5.1 GW to 5.3 GW of PV products, while for full-year the shipment outlook is between 25 GW and 30 GW. “We are well positioned to navigate through supply chain volatility and continue to manage market risks by fine-tuning our operations and shipment deliveries in 2021,” it explained.