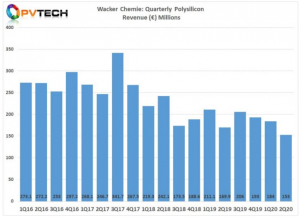

Major polysilicon producer Wacker Chemie has reported polysilicon sales of €152.5 million in the second quarter of 2020, a new low, due to weak demand and lower utilisation rates, resulting in losses of €35 million for its polysilicon division.

Wacker continues to be impacted by China’s efforts to become fully self-sufficient in the production of high-purity polysilicon for the solar industry, coupled with suppressed upstream demand with polysilicon average selling prices remaining at historically low levels. Only manufacturers with new advanced polysilicon plants are profitable, but margins have been eroded.

Wacker reported polysilicon sales of €152.5 million in the second quarter of 2020, down around 10% from the prior year period. However, Q2 2020 revenue reached a new company record low.

The firm slumped to a €35 million loss owing to to demand and ASP issues, further impacted by lower polysilicon plant utilisation rates. A year ago, Wacker had pursued a policy of full utilisation rates as it gambled unsuccessfully on polysilicon ASPs rising and being able to sell through higher inventory levels at higher margins on the back of strong demand. EBITDA was also impacted in the reporting quarter due to further reductions in inventory valuation adjustments.

Its earnings margin was -22.9% in Q2 2020, compared -7.4% in the previous quarter.

Wacker had previously said that its polysilicon division would make losses on par with those in 2019, despite cost cutting measures. However, losses are already higher than those set in the first half of 2019.