The German trade body for solar manufacturing equipment producers has said the slump in sales experienced during the first three months of the year, and falling order intake from Europe and the U.S. in the current three-month window, are both down to the effects of the spread of Covid-19.

Although China has long been the dominant source of orders for solar production lines, the Verband Deutscher Maschinen und Anlagenbau (VDMA) says the near-90% of Asian orders on the books at the moment – of which 90% are from China – is unusually high. The association says the pattern is indicative of a recovery in Covid-19-interrupted industrial activity in the Far East while at the same time testifying to the effects of coronavirus shutdowns in the U.S. and Germany, which each account for around 5% of business at the moment.

“As in the entire mechanical engineering industry, the globally interlinked value chains showed serious disruption and considerable fluctuations regarding different sales markets influenced by the corona[virus] pandemic,” said Jutta Trube, manager of the VDMA’s photovoltaic equipment division. “With an export ratio of over 90%, German PV machinery manufacturers are heavily dependent on functioning supply chains.”

Resurgence

The apparent Asian business resurgence at least offers hope for German equipment manufacturers after total sales fell 55% from the last three months of last year to the opening quarter of this – and 57% by a first-quarter, year-on-year comparison. That amounted to the worst business retreat since the German solar industry hit “rock bottom” – in the words of the VDMA – in 2012.

The trade body said its members expect Asian sales to recover by 18% on the dismal levels posted in the first quarter, with China continuing to dominate after accounting for more than 90% of Asian orders logged in the January-to-March period, ahead of Malaysia, which supplied 4% of business. Those Chinese inquiries contributed to a 37% rise in orders in the first three months of the year, compared to the final quarter of 2019.

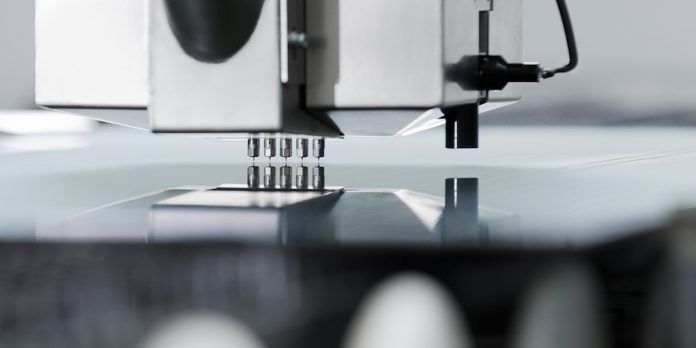

Thin-film and solar cell manufacturing equipment continue to supply virtually all of Germany’s PV production line business, accounting for 54% and 45% of orders, respectively. Equipment for the production of polysilicon, ingots, wafers and modules contributed the remaining 1% or so between them.