In 2019, the deployment of solar applications exploded throughout the United States. For safe harbor purposes, developers bought ahead of the Investment Tax Credit (ITC) decrease. At the same time, demand began to pick up for residential and small commercial installers among buyers eager to take advantage of the 30% ITC.

Despite the introduction of tariffs, demand-side market participants enjoyed the benefits of relatively low module prices. While they were involved in the game of tariff-exclusion whiplash, participants were thrilled when bifacial modules gained, lost, and regained exclusions from tariffs. As several solar cell types lend themselves to bifaciality – IBC, HIT, HJT, and PERC – the bifacial exclusion renders tariffs moot, given the gigawatt levels of capacity that are available. When the ITC review is concluded, tariffs may be firmly back in place for bifacial cells and modules.

And then a “black swan” swooped down over the global solar industry that caused manufacturers to scale back or shutter capacity across almost the entire PV manufacturing supply chain. The black swan event was the coronavirus pandemic, which has proven to be the unwanted gift that keeps on giving.

The coronavirus pandemic has stopped some Chinese PV manufacturing cold (pp. 44-47), and it has started to trickle into other markets. It will take more than one quarter to recover, as all module components – including raw materials, consumables, and finished products such as backsheets, glass, frames, wafers, and cells – have been affected.

Supply constraints and higher prices are bumping into yet another ITC decrease. The U.S. solar industry can expect tighter supplies and higher prices throughout 2020. Safe harbor buyers may find it challenging to fulfill safe harbor requirements with solar modules, and perhaps, with balance-of-system components. Those looking to install systems involving any application this year could end up missing a few deadlines. Developers, installers, module assemblers, and thin-film manufacturers across the country will need to make some tough decisions going forward.

Domestic production

The U.S. solar market hasn’t been self-sufficient since the 1990s. Currently, there is no crystalline cell production in the country. First Solar, which produces CdTe-based thin film, is the country’s primary cell manufacturer. Module assembly in the United States is growing, with more than 3 GW of assembly capacity in the country at the end of 2019, excluding First Solar.

The United States is an import market. The cells that module assemblers require must be shipped in from abroad. The country needs to import 10 GW or more for domestic module assembly in order to satisfy demand. Most of the solar glass is imported. Most backsheets are imported. Most aluminum and steel are imported. The current hiccup in the global PV supply chain could easily become a crisis for the U.S. solar market.

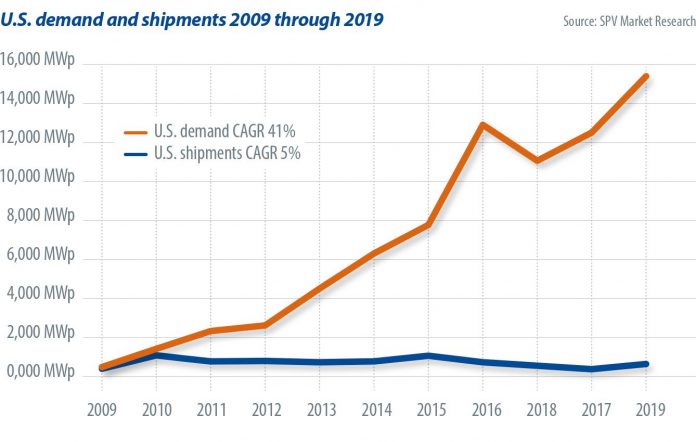

The chart to the left (bottom) details U.S. demand and shipments from 2009 through 2019. It illustrates why it is clear that the current black swan event is a problem for the U.S. solar market.

The chart to the right (top) offers a closer look at U.S. shipments from 2009 through 2019. The uptick in shipments last year was mainly due to First Solar’s increase in manufacturing capacity.

Core conclusions

At the end of 2019, U.S. demand-side participants were looking forward to a market pickup driven mainly by annual decreases in the ITC. Participants hoping for Congress to reinstate the 30% credit should temper their hope with the facts: This is an election year, and Democrats and Republicans are more partisan than ever.

Expectations for a strong 2019 continued into 2020, until supply-chain disruptions became impossible to ignore. Realistically, a dip should be expected in 2020 in the ability to fulfill demand, which is likely to remain constrained for some time. In the meantime, expect higher prices for modules.

The chart to the right offers U.S. demand from 2018 through 2022. Note that demand ticks down in 2020 for both the low and conservative scenarios.