From pv magazine, November 2019 issue

Unexpectedly low demand in China has impacted the recent state of the supply chain. It appears that the fourth quarter of the year may fall short of expectations, with only 29.8 GW of global demand, which is similar to the level in the second quarter. And the market might be dragged even lower than in the second quarter if sluggish demand continues. Clouded by uncertainty, module makers are offering record-low quotes to secure orders and maintain utilization rates.

Mono PERC module prices have consistently hit new lows in China since July. Since the tender results were released, the price of mono PERC modules has gone down to RMB 1.75-1.82/W ($0.22-0.28/W). Such price levels have caused ripples in marketplaces outside of China. Chinese module makers’ quotes for mono PERC modules were stable at $0.25-0.26/W during the third quarter, but have come down to $0.23-0.24/W recently for 390-400 W mainstream modules next year. As the market stagnation may continue through the fourth quarter, quotes for overseas markets are expected to decline even further.

To secure more orders, module makers have reduced prices significantly, while increasing the wattage output of modules for the same cost level. This has eliminated price differences between 400-405 W high-efficiency modules and 390 W mainstream modules for next year. In the face of competitive prices and power output, larger wafers have become the best shortcut to improve competitiveness. As predicted, 158.75 mm (G1) full square mono wafers will become mainstream next year. Meanwhile, some manufacturers are accelerating their R&D efforts for 166 mm (M6) mono wafers to further drive up power output.

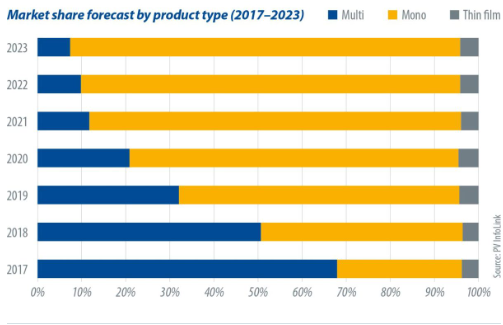

The reduction in mono-Si module prices and improvements in power output are widening the gap between mono and multi products. Taking the 72-cell layout, for instance, the mainstream wattage of mono-Si modules will reach 390-400 W, whereas that of multi-Si modules remains in the range of 340-345 W, even in the form of larger wafers and half-cut designs. In other words, the price difference may stay within $0.03/W, despite a gap of 50 W between the two products. On the strength of the price/performance ratio, mono PERC modules are edging out their multi-Si counterparts. Demand for multi-Si products plummeted in October, with multi-Si cell prices collapsing to a historic low. The average market price came in below $0.1/W at the end of October.

The impact of the downward price spiral in the cell segment is rippling toward wafer and polysilicon suppliers, and multi-Si module prices, which have long stagnated, may fall again. Despite the downward price trend, demand for multi-Si products will barely recover next year because of the widened wattage gap. Cast-mono products, achieving commercial production this year, may face challenges with price performance after mono-Si wafer prices fall next year. It is expected that the global market share of multi-Si products will fall to less than 20%.

Demand outlook

In contrast to lower Chinese demand in the final quarter, demand in the first half of 2020 may be higher than expected because of delayed projects. With overseas demand likely to rise marginally, global demand is expected to reach 131.5 GW in 2020, up 13 GW from 2019.

China will remain the largest solar market next year, while the United States and India are expected to grow continuously. On the emerging market side, some utility-scale projects in the Middle East will start construction next year, and some of them will be bifacial projects. As the UAE and Saudi Arabia will join the GW-club next year, the Middle Eastern market is expected to grow by 2 GW.

Despite growing demand, the ramp-up in manufacturing capacity across the supply chain goes beyond market growth. Mono-Si wafer and cell capacity will both exceed 30 GW again in 2020, leaving the midstream sector with the most excess capacity in the supply chain. Older capacity with no cost advantage will be gradually eliminated. The market will see continued changeover and monopolization next year.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.